Aside from housing loans, Pag-IBIG also provides financial assistance to its members through its short-term loans. These types of loans are payable within 24 months and are renewable.

The loanable amount under the short-term loans is limited to an amount which will not render the borrower’s Net Take Home Pay to fall below the minimum requirement as prescribed by the General Appropriations Act, for the public sector workers, and the company policy, for the private sector workers. However, he or she is entitled to borrow up to 80 percent of his or her total accumulated value (TAV).

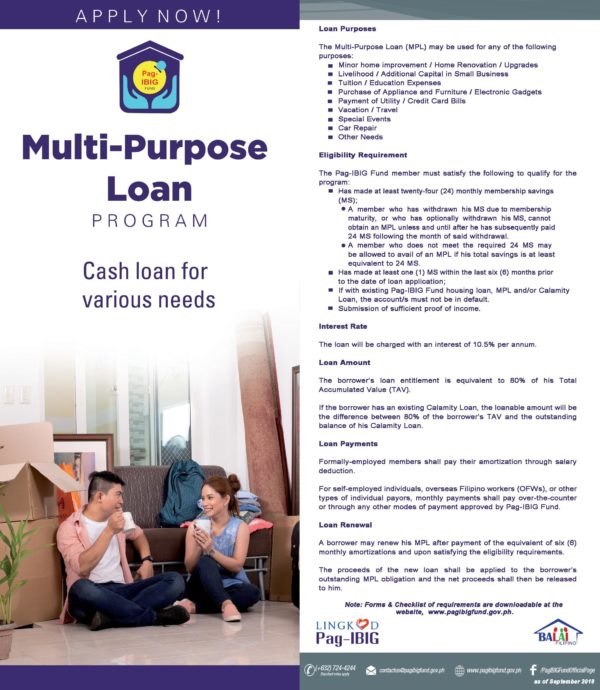

One type of Pag-IBIG short-term loan is the Multi-Purpose Loan or the MPL. To be eligible for this loan, a Pag-IBIG member must:

Meanwhile, Pag-IBIG members who reside in calamity-stricken areas, as declared by the Office of the President or the Sangguniang Bayan may avail of the Calamity Loan.

The same eligibility requirements with that of the MPL applies to Calamity Loan, as well, provided that the borrower is a resident of the area which is declared as calamity-stricken.

Renewal of the Calamity Loan is only allowed in the event that another calamity occurs in the same area. However, the outstanding balance of his existing loan, together with any accrued interests, penalties, and charges, shall be deducted from the new loan proceeds.

The MPL and the Calamity Loan is separate and distinct from each other. As such, a Pag-IBIG member may avail of the other type of short-term loan while he or she has an MPL or Calamity Loan. However, if the member availing of an MPL has an existing Calamity Loan or vice versa, the balance of the Calamity Loan will not be deducted from the proceeds of the MPL.

Are you more interested in taking a Pag-IBIG housing loan? Here’s what you need to know about it.

Looking for a savings program with higher dividend returns? Why not look into Modified Pag-IBIG II Program?